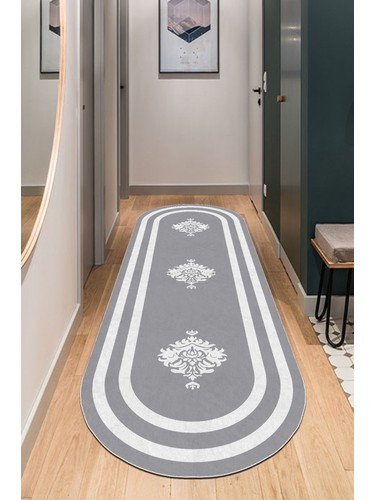

GRİ HOME HALI Kaymaz Dot Taban Gri Oval Halı Makinada Yıkanabilir Yolluk Mutfak Halısı-gr1003 Fiyatı, Yorumları - Trendyol

Decomia Home Dijital Kaymaz Yıkanabilir Bej Salon Halısı Mutfak Halısı Koridor Halısı Oval Halı Yolluk-d7024 Fiyatı, Yorumları - Trendyol

Decomia Home Dijital Kaymaz Yıkanabilir Modern Salon Halısı Mutfak Halısı Koridor Halısı Oval Halı Yolluk DC-1182.Oval Fiyatları ve Özellikleri

Dijidekor 8881 Gri Siyah Saçaksız Dijital Oval Halı Kaymaz Yıkanabilir Yolluk 140x200 Fiyatı, Yorumları - Trendyol

DijiDekor Kaymaz Taban Dijital Oval Halı Salon Banyo Oda Koridor Mutfak Halısı 8881 Siyah 80X150 : Amazon.com.tr: Ev ve Yaşam