Pioneer AVH-Z9250BT Kablosuz Apple CarPlay Android Auto Multimedya Sistemi : Amazon.com.tr: Elektronik

Pioneer launches its largest-ever in-car multimedia screen in Singapore, the new Z Series head units CarBuyer Singapore

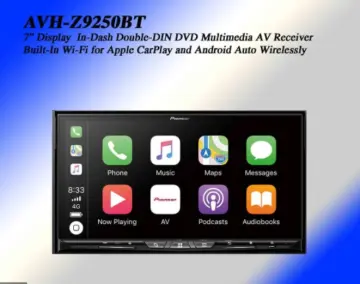

Pioneer AVH-Z9250BT 7” WVGA Touch-screen Multimedia player with Apple CarPlay, Android Auto & Bluetooth

Pioneer AVH-Z9250BT Kablosuz Apple CarPlay Android Auto Multimedya Sistemi : Amazon.com.tr: Elektronik

PIONEER AVH Z9250BT WIRELESS Android Auto Apple Carplay WiFi Certified Waze Spotify Youtube Apple Music Google Map Siri Hey Google | Lazada PH

Pioneer Avh-z9200dab Kablosuz Apple Carplay Android Auto Multimedya Sistemi Fiyatı, Yorumları - Trendyol